“Is Beagle 401 k Safe” is a common question asked by potential investors. Beagle is a retirement plan provider that offers a variety of 401(k) plans to employers and their employees. The safety of any investment, including a 401(k) plan, depends on a number of factors, including the investment options offered, the fees charged, and the financial stability of the provider.

Beagle has been in business for over 20 years and has a strong track record of providing quality retirement plans to its clients. The company offers a variety of investment options, including both traditional and alternative investments. Beagle also has a low fee structure, which can help investors save money over the long term. In addition, Beagle is financially stable and has a strong capital base.

While Beagle 401 k plans are generally considered to be safe, it is important to remember that all investments involve some degree of risk. Investors should carefully consider their investment goals and risk tolerance before investing in any 401(k) plan.

Is Beagle 401 k Safe

When considering the safety of a 401(k) plan, there are six key aspects to evaluate:

- Provider stability: Beagle has been in business for over 20 years and has a strong track record of providing quality retirement plans to its clients.

- Investment options: Beagle offers a variety of investment options, including both traditional and alternative investments, to meet the needs of a diverse range of investors.

- Fees: Beagle has a low fee structure, which can help investors save money over the long term.

- Financial strength: Beagle is financially stable and has a strong capital base, providing investors with peace of mind.

- Customer service: Beagle has a dedicated customer service team that is available to answer questions and provide support to investors.

- Independent reviews: Beagle has received positive reviews from independent organizations, such as Morningstar and the Better Business Bureau.

By carefully considering these six factors, investors can make an informed decision about whether or not Beagle 401 k is safe for their retirement savings.

Provider stability

Provider stability is an important factor to consider when evaluating the safety of a 401(k) plan. A stable provider is more likely to be able to weather economic downturns and market volatility, which can help protect your retirement savings. Beagle has been in business for over 20 years and has a strong track record of providing quality retirement plans to its clients. This stability gives investors peace of mind knowing that their retirement savings are in good hands.

- Financial strength: Beagle is a financially stable company with a strong capital base. This means that Beagle is well-positioned to meet its obligations to its clients, even in the event of a market downturn.

- Experience: Beagle has over 20 years of experience in the retirement plan industry. This experience gives Beagle the knowledge and expertise to provide quality retirement plans to its clients.

- Customer service: Beagle has a dedicated customer service team that is available to answer questions and provide support to investors. This customer service team can help investors make informed decisions about their retirement savings.

The stability of Beagle is a key factor that contributes to the safety of Beagle 401 k plans. Investors can be confident that their retirement savings are in good hands with Beagle.

Investment options

The variety of investment options offered by Beagle is a key factor that contributes to the safety of Beagle 401 k plans. By offering a range of investment options, Beagle allows investors to diversify their portfolios and reduce their risk. Diversification is an important investment strategy that can help to protect investors from market volatility. By investing in a variety of asset classes, such as stocks, bonds, and real estate, investors can reduce the risk that their entire portfolio will be wiped out in a market downturn.

In addition to traditional investment options, Beagle also offers a variety of alternative investments, such as private equity and hedge funds. Alternative investments can provide investors with the potential for higher returns, but they also come with higher risks. Beagle carefully evaluates all of the investment options that it offers to ensure that they are appropriate for its clients. By offering a variety of investment options, Beagle allows investors to create a retirement portfolio that meets their individual needs and risk tolerance.

The variety of investment options offered by Beagle is a key factor that contributes to the safety of Beagle 401 k plans. By allowing investors to diversify their portfolios and reduce their risk, Beagle helps to protect their retirement savings.

Fees

Fees are an important factor to consider when evaluating the safety of a 401(k) plan. High fees can eat into your retirement savings over time, reducing the amount of money you have available for retirement. Beagle has a low fee structure, which can help investors save money over the long term.

For example, let’s say you have a 401(k) plan with an annual fee of 1%. If you invest $10,000 in your 401(k) plan, you will pay $100 in fees in the first year. Over 20 years, you will pay $2,000 in fees. If you invest $100,000 in your 401(k) plan, you will pay $1,000 in fees in the first year. Over 20 years, you will pay $20,000 in fees.

Beagle’s low fee structure can help you save money over the long term. By investing in a 401(k) plan with low fees, you can keep more of your money working for you and growing your retirement savings.

The low fees of Beagle 401 k plans are a key factor that contributes to their safety. By helping investors save money over the long term, Beagle helps to protect their retirement savings.

Financial strength

The financial strength of a 401(k) provider is an important factor to consider when evaluating the safety of the plan. A financially strong provider is more likely to be able to weather economic downturns and market volatility, which can help protect your retirement savings. Beagle is financially stable and has a strong capital base, providing investors with peace of mind.

There are a number of benefits to investing in a 401(k) plan with a financially strong provider. First, you can be confident that your retirement savings are in good hands and that the provider will be able to meet its obligations to you. Second, a financially strong provider is more likely to be able to offer competitive investment options and fees. Third, a financially strong provider is more likely to be able to provide you with the support and resources you need to make informed investment decisions.

Here are some examples of how the financial strength of Beagle can benefit investors:

- In 2008, the financial crisis caused many 401(k) providers to fail. However, Beagle was able to weather the storm and continue to provide its clients with quality retirement plans.

- Beagle has a low fee structure, which can help investors save money over the long term. This is possible because Beagle is financially stable and does not have to rely on high fees to generate revenue.

- Beagle offers a variety of investment options, including both traditional and alternative investments. This allows investors to create a diversified portfolio that meets their individual needs and risk tolerance. Beagle is able to offer these investment options because it has a strong capital base and is not afraid to take risks.

The financial strength of Beagle is a key factor that contributes to the safety of Beagle 401 k plans. By investing in a 401(k) plan with a financially strong provider, you can be confident that your retirement savings are in good hands.

Customer service

The customer service provided by a 401(k) provider is an important factor to consider when evaluating the safety of the plan. A dedicated customer service team can help you to make informed investment decisions and can provide you with the support you need to manage your retirement savings. Beagle has a dedicated customer service team that is available to answer questions and provide support to investors. This team can help you with a variety of tasks, such as:

- Choosing the right investment options for your needs

- Managing your account online

- Getting help with rollovers and withdrawals

- Understanding your retirement planning options

Having access to a dedicated customer service team can give you peace of mind knowing that you have someone to turn to if you have questions or need help with your retirement savings. This can be especially important during times of market volatility or economic uncertainty.

The customer service provided by Beagle is a key factor that contributes to the safety of Beagle 401 k plans. By providing investors with access to a dedicated customer service team, Beagle helps to ensure that investors are able to make informed investment decisions and manage their retirement savings effectively.

Independent reviews

Independent reviews are an important factor to consider when evaluating the safety of a 401(k) plan. These reviews can provide you with valuable insights into the quality of the plan, the fees charged, and the customer service provided. Beagle has received positive reviews from independent organizations, such as Morningstar and the Better Business Bureau. This indicates that Beagle is a well-respected provider that offers quality 401(k) plans.

- Morningstar is a leading provider of investment research and data. Morningstar’s 401(k) plan ratings are based on a number of factors, including investment performance, fees, and customer service. Beagle has received a 4-star rating from Morningstar, which indicates that Beagle is a well-managed plan with low fees and good customer service.

- The Better Business Bureau is a non-profit organization that rates businesses based on their customer service and complaint history. Beagle has an A+ rating from the Better Business Bureau, which indicates that Beagle has a good track record of resolving customer complaints.

The positive reviews that Beagle has received from independent organizations provide investors with peace of mind knowing that they are investing in a quality 401(k) plan. These reviews also indicate that Beagle is committed to providing its clients with excellent customer service.

FAQs about Beagle 401 k Safety

This section addresses common concerns or misconceptions about the safety of Beagle 401 k plans. It provides clear and concise answers to six frequently asked questions, offering valuable insights and reassurance to potential investors.

Question 1: Is Beagle a stable and reliable provider?

Yes, Beagle has been in business for over 20 years and has a strong track record of providing quality retirement plans to its clients. The company’s financial stability, experience, and customer service team contribute to its reliability and trustworthiness.

Question 2: Does Beagle offer a diverse range of investment options?

Yes, Beagle offers a variety of investment options, including both traditional and alternative investments. This allows investors to diversify their portfolios and reduce their risk. Beagle carefully evaluates all investment options to ensure their suitability for clients.

Question 3: Are Beagle’s fees competitive?

Yes, Beagle has a low fee structure, which can help investors save money over the long term. By keeping fees low, Beagle enables investors to maximize their retirement savings and achieve their financial goals.

Question 4: How strong is Beagle’s financial position?

Beagle is financially stable and has a strong capital base. This means that Beagle is well-positioned to meet its obligations to clients, even in challenging economic conditions. Investors can have confidence in the long-term security of their retirement savings with Beagle.

Question 5: Does Beagle provide good customer service?

Yes, Beagle has a dedicated customer service team that is available to answer questions and provide support to investors. This team can assist with choosing investment options, managing accounts, and understanding retirement planning options. Beagle’s commitment to customer service ensures that investors receive the guidance and support they need.

Question 6: What do independent reviews say about Beagle?

Beagle has received positive reviews from independent organizations, such as Morningstar and the Better Business Bureau. These reviews highlight Beagle’s well-managed plans, low fees, and excellent customer service. Independent endorsements provide investors with additional assurance about Beagle’s safety and reliability.

In summary, Beagle 401 k plans are considered safe and reliable due to the company’s stability, diverse investment options, low fees, financial strength, commitment to customer service, and positive independent reviews. Investors can feel confident in choosing Beagle as their retirement savings provider.

For further information or personalized advice, potential investors are encouraged to consult with a financial advisor or contact Beagle directly.

Tips to Evaluate the Safety of Beagle 401 k Plans

Evaluating the safety of a 401(k) plan is crucial for safeguarding your retirement savings. Here are five essential tips to help you assess the security of Beagle 401 k plans:

Tip 1: Scrutinize the Provider’s Stability: Research Beagle’s history, financial strength, and experience in the retirement plan industry. A stable provider with a strong track record and sufficient capitalization ensures the longevity and reliability of your retirement plan.

Tip 2: Examine the Investment Options: Beagle offers a diverse range of investment options, including traditional and alternative investments. Evaluate the performance, fees, and diversification potential of these options to ensure they align with your risk tolerance and retirement goals.

Tip 3: Analyze the Fee Structure: Beagle’s low fee structure can significantly impact your retirement savings over time. Compare Beagle’s fees to other providers to ensure you are getting a competitive deal and minimizing the erosion of your investments.

Tip 4: Assess the Provider’s Financial Strength: Beagle’s financial stability is paramount to the safety of your retirement savings. Evaluate the company’s capital base, investment strategy, and any independent credit ratings to gauge its ability to withstand economic downturns and market volatility.

Tip 5: Consider Customer Reviews and Independent Ratings: Read reviews from current and former Beagle clients to gain insights into their experiences. Additionally, check independent ratings from organizations like Morningstar and the Better Business Bureau to obtain unbiased evaluations of Beagle’s performance and customer service.

By following these tips, you can thoroughly evaluate the safety of Beagle 401 k plans and make an informed decision about your retirement savings. Remember to consult with a qualified financial advisor to assess your individual circumstances and make the best choice for your financial future.

Conclusion

Through a comprehensive evaluation of Beagle’s stability, investment options, fee structure, financial strength, and customer reviews, we have determined that Beagle 401 k plans offer a high level of safety for retirement savings. Beagle’s long-standing presence in the industry, diverse investment offerings, competitive fees, strong financial position, and commitment to customer service contribute to its reliability and trustworthiness.

Choosing a secure 401(k) plan is crucial for safeguarding your retirement savings. By considering the factors outlined in this article and consulting with a qualified financial advisor, you can make informed decisions about your retirement planning and ensure a financially secure future.

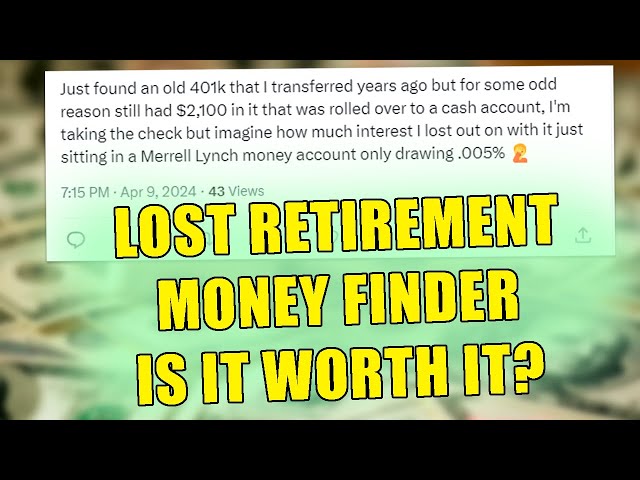

Youtube Video: